NEW DELHI: The core group on asset monetization has pulled up railways for its poor track record in monetising stations, passenger trains and freight terminals, while ticking off the tourism department for the “very slow” progress in the Ashok Hotel transaction.

The panel of top officers led by cabinet secretary TV Somanathan was also critical of the telecom department (DoT) for dropping plans to monetise BSNL’s telecom tower, telling officials that it was essential to push the proposal as govt funding could not be the sole source of meeting the ailing PSU’s debt obligation.

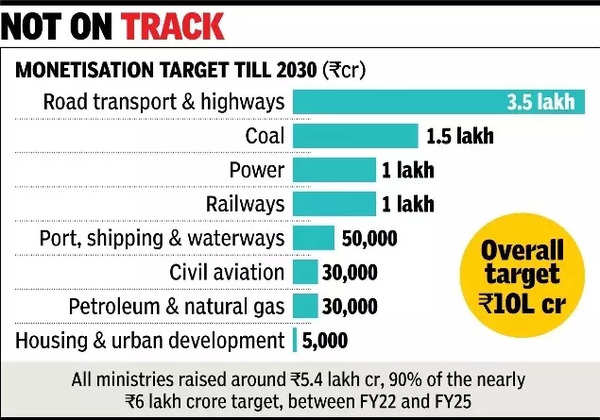

Petroleum ministry too has been asked to revive plans to monetise the gas pipeline network with a Rs 30,000 crore target fixed for the next asset monetisation cycle that was announced by finance minister Nirmala Sitharaman with the Centre looking at mopping up Rs 10 lakh crore through the route by 2030.

The core group, which met early last month, did not accept railway board chairman Satish Kumar’s plea to lower the target from Rs 1.7 lakh crore to Rs 1 lakh crore, the same as the last cycle, when the national transporter could achieve only 30% of the target as the bureaucracy blocked all moves to monetise assets and instead sought to do everything in-house. Sources familiar with the deliberations said that Kumar was clearly told that the Rs 1 lakh crore target was unacceptable but was given time to come back with a plan, including some innovative options.

The discomfort with the ministries was evident as the housing and urban affairs land monetisation in the capital was seen to be “too low” with only Rs 5,000 crore targeted, especially when it is sitting on prime commercial land. So far, the ministry has got NBCC to sell property largely to public sector companies and govt entities in its projects that have come up in East Kidwai Nagar, Nouroji Nagar and even in Netaji Nagar.

Sources said that when it came to monetisation of the land bank – where surplus land from PSUs is transferred – govt is looking at the fund raised through this route to be outside the Rs 10 lakh crore target for asset monetisation, indicating that there will be a focus on this segment given the limited success in the past, most of which came by way of Infrastructure Investment Trust (InvIT) by NHAI and PowerGrid as well as Toll-Operate-Transfer (TOT) route.

This time, the road transport ministry has been given a target of monetizing 35,000 km to raise Rs 3.5 lakh crore – 2.7 times higher than the last round, which is 35% of the entire asset monetisation target across all ministries.

Ministry’s fresh directive may slow down highway monetisation

Meanwhile, the road transport ministry on February 21, directed NHAI to put on hold the process of bidding of TOT projects while adding that InvIT has been more beneficial to govt. The ministry has instructed NHAI to undertake a detailed comparative analysis of monetisation through InvIT and TOT and give it to minister Nitin Gadkari’s office within a month.

“The process of bidding of TOT bundles be kept on hold till such an analysis is completed and presented,” the letter said. Sources said this may slow down pace of highway monetization considering that the NHAI now needs to more than double the pace of monetisation to meet the target.

So far the TOT mode of asset monetisation has been around 38% to the total highway monetisation share by the NHAI since 2018-19.

The ministry has suggested that NHAI can adopt a medium-term toll monetisation under which a five-year tolling right may be given to the highest bidders in place of the present norm of 15 years.

It has also suggested the highways authority to consider securitisation of toll receivables from banks and financial institutions through special purpose vehicles on the lines of Delhi-Mumbai Expressway Development Limited (DMEDL). The ministry has asked the NHAI to formulate a scheme to implement the models of securitisation and monetisation within one month and submit them.